Financial confidence is a crucial aspect of overall well-being, especially for women who often face unique challenges in their financial journeys. By developing a strong sense of financial confidence, women can take control of their money, make informed decisions, and work towards their long-term financial goals.

Understanding the Confidence Gap

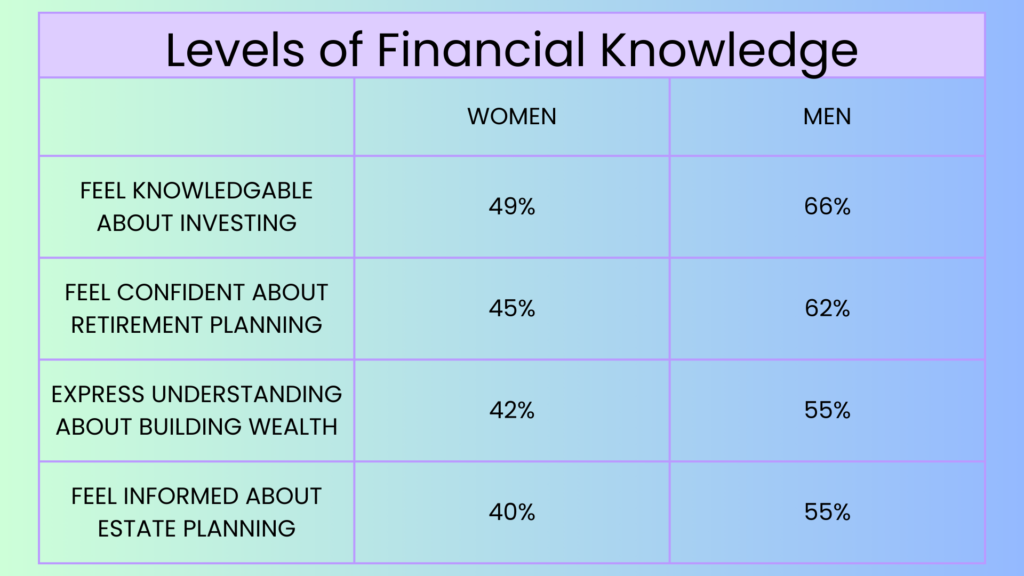

Recent studies have revealed a significant confidence gap between men and women when it comes to financial matters. According to New York Life’s Wealth Watch survey, women consistently report lower levels of financial knowledge compared to men across various topics:

This confidence gap often translates into real-world financial behaviors and outcomes. However, it’s important to note that confidence doesn’t always equate to competence. In fact, women tend to save more money as a percentage of their income compared to men, demonstrating strong financial habits despite lower reported confidence levels.

Steps to Build Financial Confidence

- Commit to Your Goals

The first step in building financial confidence is setting clear, achievable goals. Whether it’s saving for a down payment on a house, planning for retirement, or starting an investment portfolio, having specific objectives gives you direction and motivation.

- Educate Yourself

Knowledge is power, especially when it comes to finances. Take advantage of the wealth of resources available:

- Read financial books and blogs

- Attend workshops or webinars

- Use free online courses and tools

Encouragingly, younger generations of women are receiving more formal financial education. The New York Life survey found that Gen Z and Millennial women report higher rates of financial literacy education compared to Gen X and Baby Boomer women.

- Start Small and Build Momentum

Begin with manageable financial tasks to build your confidence:

- Create a budget and stick to it for a month

- Set up automatic savings transfers

- Research and open a high-yield savings account

As you successfully complete these tasks, your confidence will grow, encouraging you to tackle more complex financial challenges.

- Seek Professional Guidance

Don’t hesitate to consult with financial professionals. A study by Flourish Wealth Management found that working with a financial advisor can significantly boost confidence in money matters[1]. Look for someone you feel comfortable with and who understands your unique financial situation and goals.

- Practice Self-Affirmation

Recognize and celebrate your financial achievements, no matter how small. This positive reinforcement can help counteract self-doubt and build confidence over time.

Overcoming Common Challenges

Women often face unique financial challenges that can impact their confidence:

- Caregiving Responsibilities: Many women find themselves in caregiving roles, which can strain finances and career progression. Over 60% of caregivers report that these responsibilities have prompted them to become better at building and adjusting financial strategies.

- Wage Gap: Despite progress, women still earn less on average than men. This makes it even more crucial to develop strong financial skills and confidence.

- Longer Life Expectancy: Women typically live longer than men, necessitating more robust retirement planning and investment strategies.

The Impact of Financial Confidence

Building financial confidence can have far-reaching effects:

- Improved overall well-being and reduced stress

- Better negotiation skills for salaries and financial agreements

- More informed decision-making in investments and major purchases

- Increased likelihood of achieving long-term financial goals

It’s important to remember that financial confidence is a journey, not a destination. It’s about continuous learning, adapting to new circumstances, and believing in your ability to manage your financial life effectively.

By taking these steps and persistently working on your financial knowledge and skills, you can build the confidence needed to take control of your financial future and achieve your goals.